Keep reading to discover trading methods to avoid psychological hurdles using recent trading to illustrate…

We’ve all experienced the difficulty of piecing together a jigsaw puzzle.

Now imagine attempting that puzzle without ever seeing the final picture. It becomes daunting lacking the guiding vision necessary to piece it together.

When executed properly your game plan projects a vision of the market’s future movements—eliminating the daunting prospect of trading blindly.

It’s not some ‘black-box’ approach you can glean from a book or video. Accurate game planning takes a problem-solving approach.

Vital for trading success did you know this skill is well-suited to mature individuals as the brain excels at problem-solving in later stages of life?

Just as surgeons refine their skills by following evidence-based practices, your game plan succeeds by following evidence-based processes.

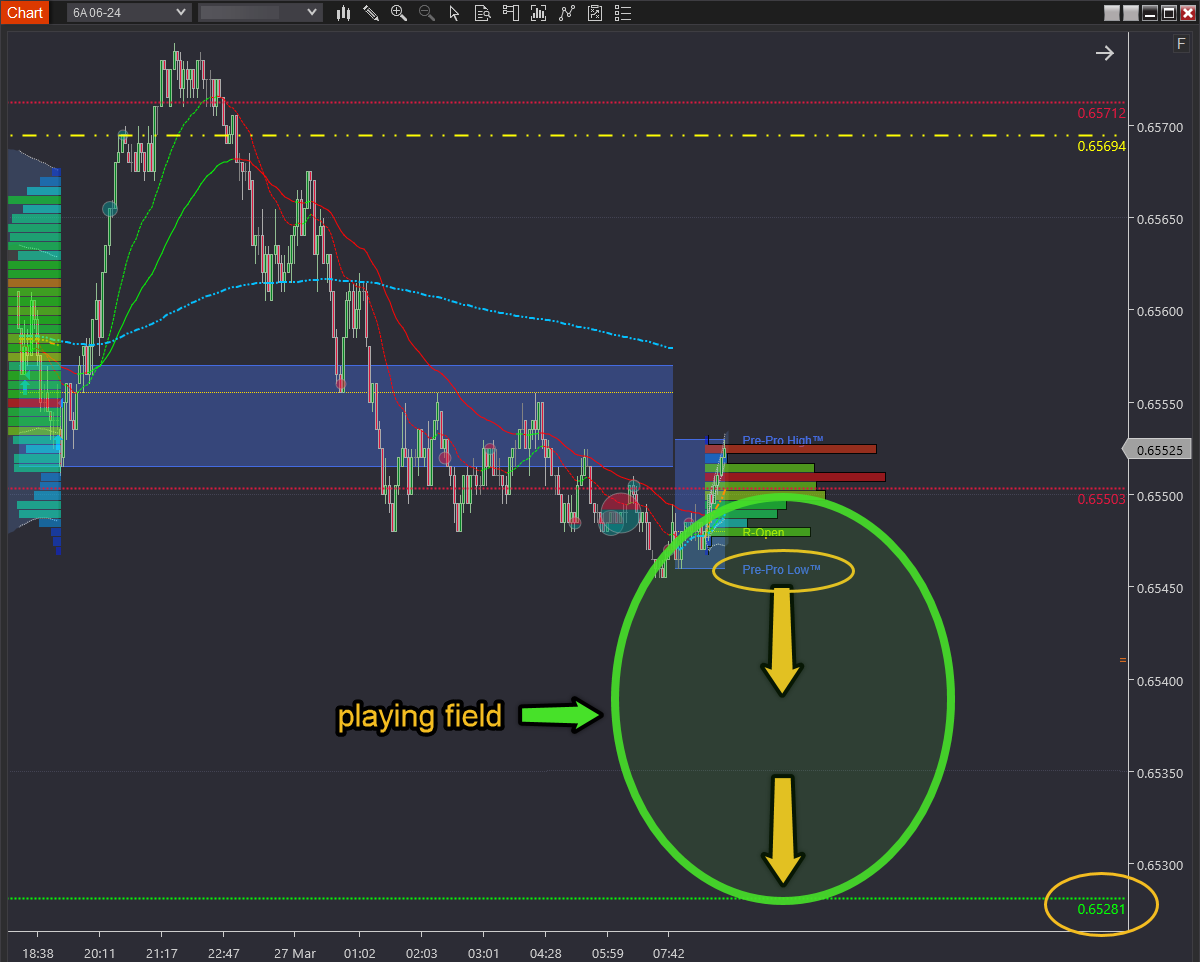

The game plan indicated the market would move from the Pre-Pro-Low to the ‘transition’ at 0.6528, so we’ll trade this scenario.

Why not enter now?

On the surface it seems straightforward. Trading a movement like the one described is often depicted as entering the market, setting a stop loss and profit target, and ensuring a favourable risk-to-reward ratio like 1:3 or 1:5. Then you’re all set.

But when you attempt this method, you discover that rewards are few while losses are common—hence the saying, “You win some you lose more.” Sound familiar?

If there were a simplified version of trading akin to Monopoly that even grade schoolers could understand, it might look something like this.

However, trading is highly competitive, like Premier League competition, where profitable strategies are closely guarded.

What else comes to mind when you imagine a surgeon practising their craft. Precision. Agree?

Surgical precision also applies to timing your trades. Of the many ways prices move, only specific ‘price personalities‘ enable precise and timely trade execution—much like a skilled surgeon performing a meticulous procedure. But before we dive in:

Let’s play a game

Consider your trade size is 20 lots. For each basis point movement in price, your account fluctuates by USD 200. For instance, a 10-basis point shift translates to a USD 2000 change in your account balance. Looking at the chart below, would you enter short now?

How about now?

Or should you go short now?

If you’d held your short from the pink arrow, you’d be down approximately USD 1000, a little better than the USD 1600 you were down minutes earlier.

But it could get much worse from here. Correct? You’ll see what happened in a minute.

But before you see the trades, in fairness, that was a ‘loaded’ game.

Merely showing you a chart gave you as much chance of winning as you have of winning a call of “tails” on the flip of a double-headed coin.

In the trading below the chart shows the execution precision only in hindsight. But using charts alone it’s impossible to replicate precise entries in real time. I should know—the trades below are mine.

What observations can you make about the following trades?

- The first short attempt initially moved in my favour before being closed for a minimal loss (1 bps).

- The second trade is a long position—half closed for a small profit and half exited at the same entry price.

- The third trade involves two entries at different prices. When there is no risk of the overall trade losing money, the trade size increases through additional positions.

Did you notice none of the trades initially moved into the red zone? How much more confident would you be if your trading followed a similar pattern?

Why use the approach I do?

I employ an approach that avoids common challenges traders face including:

- It’s consistently effective not just during specific market cycles.

- It mitigates significant drawdowns.

- It caps losses to ‘papercuts’—easy to execute, unlike deer-in-the-headlights-sized losses.

- It allows you to increase your payout without taking more risk (similar to the trade above).

- It relies on evidence-based processes that you can reliably follow.

- It demands a continuous state of engagement, reducing the chance of psychological sabotage.

- Through its repetitive nature, it fosters self-regulation while organically building your confidence.

As for the ‘how,’ that’s where investing in professional mentoring and ongoing reviews comes in to avoid the frustration and aggravation of years of experiencing the challenges mentioned earlier.

Trading that has your back

Amid market uncertainties facing fewer challenges naturally fosters a cool and calm disposition.

With an evidence-based approach staying engaged and connected to the market becomes second nature.